According to the final full-year data from the U.S. Tire Manufacturers Association (USTMA), sales in the U.S. replacement tire market for passenger cars, light trucks, and trucks and buses will fully recover in 2021, almost back to pre-2020 levels and even beyond 2019. previous level.

The replacement market grew 10.3% year over year

According to the data of USTMA, 224.7 million pcs PCR tires has been sold in USA in 2121, an increase of 10.3% year over year. Among them, the light truck tire replacement market shipped 38.6 million units, an increase of 17.2% year-on-year in 2020. The sales volume of the truck and bus tire market has experienced explosive growth, reaching 22.8 million units, a year-on-year increase of 19.3%.

The original equipment market increased by 0.7% year-on-year

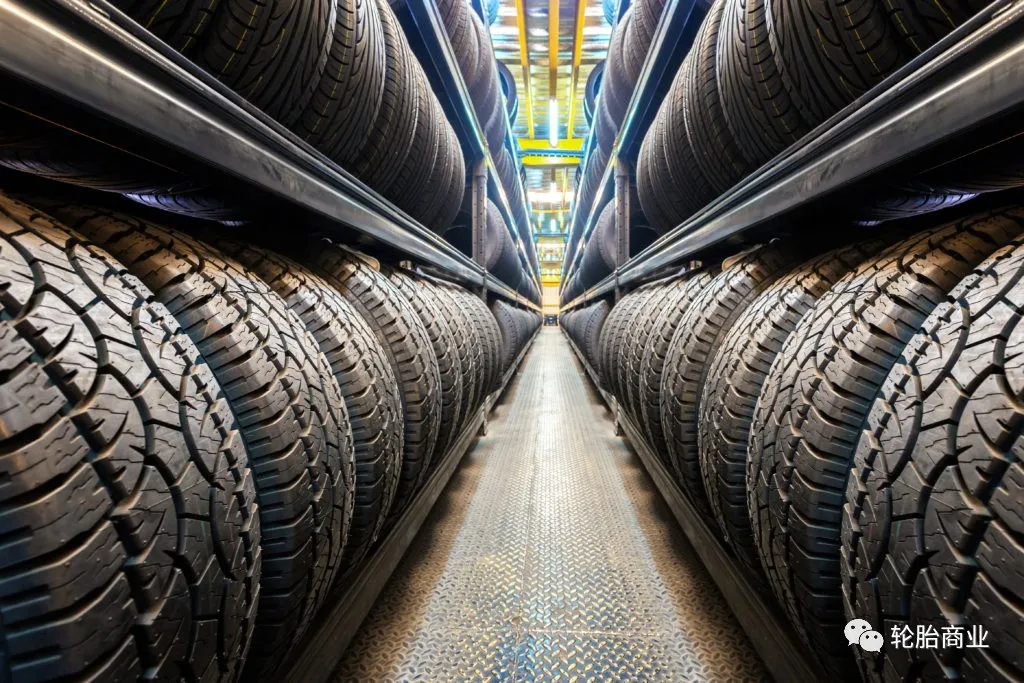

Despite the massive increase in sales, U.S. dealers couldn't laugh at it for no other reason - worrying about inventory. In fact, many small and medium-sized dealers in the United States have already started the "snap-buying" mode. Since April last year, due to factors such as the reduction in the shipping turnover rate, the tire inventory in the North American market has issued a "bottom warning". The infection of seafarers has affected the occupancy rate of ships, aggravating the situation that a box is hard to find, and pushing up the price of sea freight; the infection of a large number of workers in the port has led to a shortage of manpower, and the cycle of entering and leaving the port has been extended again; the shortage of freight workers has caused the cycle and freight to be high again. . The fragile supply chain has directly led to the dilemma of "no goods to take" for tire dealers.

Of course, large overseas dealers can relieve the pressure of purchasing goods by building warehouses at the dock and organizing fleet transportation; small dealers can only watch the loss of customers due to "out of stock" due to lack of funds.

Therefore, although the sales in the domestic market of the United States have shown a blowout growth, for the relatively weak tire companies, they

In 2021, the tire original equipment market was affected by unfavorable factors such as the shortage of chips in 2021, and sales declined to a certain extent in the third quarter. However, looking at the annual sales volume, the original equipment sales in the US market in 2021 will still exceed the level of the whole year in 2020. In the truck and bus field, which has experienced labor shortages and personnel shortages, its tire sales have also risen sharply. (Some industry insiders previously speculated that the reason for this phenomenon is that the severe overseas epidemic has led to a sharp increase in its online consumption, and the increase in demand in the transportation industry has led to an increase in the sales of original tires.)

In terms of specific data, in 2021, the sales volume of original passenger car tires in the US market will be 37.4 million, a year-on-year increase of 0.7%; the shipment of original light truck tires will be 5.6 million, a year-on-year increase of 4.9%; total shipments of original truck tires The volume was close to 5.9 million, an increase of 25% over the full year level of 2020.

U.S. dealers run out of stock

are facing an unprecedented "stock crisis", and they have not really tasted the "sweetness" brought by high demand. At present, overseas tire dealers are "stunned" by another bad news - sea freight prices seem to be going up again.

Bad news keeps coming

As the International Coastal and Warehouse Union (ILWU) of the West American dockworkers is about to renew the contract that expires at the end of June this year, the salary negotiation of the West American dockworkers may become the decisive factor affecting the global supply chain this year - once the bargaining power is gained of workers on strike, and freight rates may rise sharply.

However, analysts mentioned that although this news may make the shipping price continue to enter the "darkness" situation, due to the previous US infrastructure bill allocated a lot of port construction funds, its benefits are expected to emerge in early 2023, so in 2023 It could be the last "dark hour" that leads to losing all the money. Therefore, many overseas dealers still decide to continue to "suffer" and adopt various methods to stock up, hoping that the day of making money will come again after the supply chain gradually returns to normal in 2023.