At the beginning of September, domestic tire companies collectively started a wave of price increases. What caused this? The reporter visited Guangrao County, Dongying, Shandong, a major production base of domestic tires.

Sales slow down and inventory backlog

Some tire companies cut production

In the park of a tire factory in Guangrao, Shandong, many TBR tires have been piled up outside the warehouse.

In addition to raw materials, the cost of ocean freight is also rising. This year's ocean freight, which has soared more than ten times, has also affected tire export sales.

Manager:The value of a container of tires is not as good as the value of shipping costs. For example, one container of tyres to the United States may be worth US$20,000, while the value of a container of our goods may be US$15,000 to US$17,000.

Tire dealers' profit margins decline

Rising costs are forcing tire manufacturers to raise prices. This is not good news for tire dealers. Right now is the peak consumption season of the Golden 9th and the Silver 10th, but the sales of tires are not good.

![]() Li Tao, who is checking the delivery situation in the warehouse, has been selling all-steel tires for trucks in Guangrao, Shandong for many years. He told reporters that from the second half of last year to the first quarter of this year, tire sales have been good, and he has a lot of goods. Unexpectedly, then the market began to turn cold. Entering the traditional peak season in August and September, no obvious improvement was seen.

Li Tao, who is checking the delivery situation in the warehouse, has been selling all-steel tires for trucks in Guangrao, Shandong for many years. He told reporters that from the second half of last year to the first quarter of this year, tire sales have been good, and he has a lot of goods. Unexpectedly, then the market began to turn cold. Entering the traditional peak season in August and September, no obvious improvement was seen.

Another dealer, Jiang Jiangxi, mainly sells semi-steel tires for cars. He told reporters that although their current market situation is stronger than that of truck tires, there is also no room for price increases.

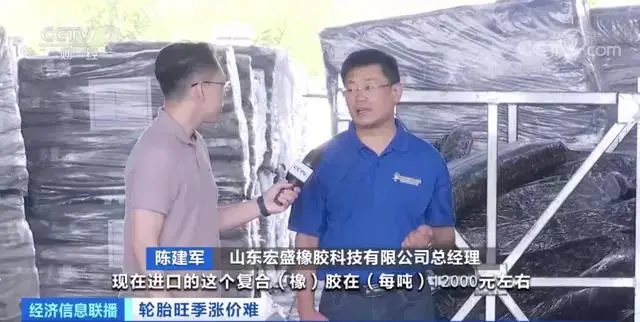

According to the person in charge of the company, sales of this type of all-steel tires are not satisfactory this year. On the other hand, tire companies are facing considerable pressure on the cost side this year.

Manager :Now the imported composite rubber is about 12,000 yuan per ton, and 7,000 yuan per ton when it is low, which puts a lot of pressure on the production cost of tires.

Compared with TBR tires, the current sales of PCR tires are better. However, the overall profit of the industry is severely squeezed by rising raw material costs.

Manager :Compared with last year, our PCR tire sales this year increased by 20% in the first half of the year, and the comprehensive cost of raw materials increased by about 40%. This year, we are in a relatively low profit.

Manager:The reports of all listed tire companies show that their revenue has increased year-on-year, but from the perspective of net profit, only 4 companies have shown an increase year-on-year, and other listed tire companies have shown varying degrees of decline.

The tire market is optimistic in the long run

Companies aiming for new categories

The tire industry is currently under great pressure, whether it is on the production side or on the sales side. There is a dilemma between rising and not rising, so how can tire companies improve their competitiveness and find a new way out?

At present, many companies in the industry are also increasing R&D investment in response to the demand for new energy vehicles or special vehicles to produce new types of tires with higher profit margins.

Data show that in 2020, the number of motor vehicles in the country will reach 372 million, and the cumulative output of rubber tires in the country will be 818 million. Faced with a huge and still growing market, leading domestic companies have also expanded production at home and abroad. Industry insiders believe that expansion also requires increased investment in technology research and development.