After many South Asian economies fell into financial turmoil this year, what trigger crises will the global market face next year? As we look ahead to the end of the year, we set our sights on Europe...

Currency crisis will break out in Europe next year?

Recently, Nomura analysts said in their latest report that due to increased fiscal and external challenges, even continental Europe is not immune to the threat of exchange rate collapse, and the Czech Republic, Romania and Hungary will face the risk of a currency crisis within the next year.

The conclusion was drawn by Nomura analysts based on the Damocles index compiled by the bank. The index is based on an analysis of eight indicators, including the import coverage ratio of foreign exchange reserves, real short-term interest rates, and fiscal and current account measures, to assess the vulnerability of the 32 countries in the sample to currency crises.

Affected by the Russia-Ukraine crisis, the currencies of the above-mentioned three Eastern European countries mentioned by Nomura are indeed volatile this year, especially the Hungarian Forint.

The Hungarian forint has plunged nearly 18 percent against the dollar this year, making it one of the worst-performing emerging-market currencies this year. In September, the European Commission proposed suspending 70 percent of the 22.5 billion-euro cohesion fund earmarked for Hungary in the EU's 2021-2027 budget to force Hungary to undertake judicial reform.

In addition, the Romanian and Czech currencies have also lost about 8% against the US dollar this year. Due to their proximity to Russia and Ukraine, the above-mentioned Eastern European countries have been most affected by the Russia-Ukraine crisis.

Seven emerging economies at risk of currency crisis

It is worth mentioning that with the sharp rise of the US dollar, geopolitical pressure and central bank mistakes are indeed pushing many emerging currencies into a "fatal spiral" this year.

Fragility in emerging market currencies is now at its highest point in more than two decades, Nomura analysts Rob Subbaraman and Si Ying Toh wrote in a new report, and issued an "ominous warning" of increasingly widespread risks.

The report also pointed out that seven countries, Egypt, Romania, Sri Lanka, Turkey, the Czech Republic, Pakistan and Hungary, are currently facing a high risk of a currency crisis.

The Japanese bank said risks had risen in 22 of the 32 countries covered by its internal Damocles warning system since May, with the biggest increases in the Czech Republic and Brazil.

By analyzing eight key indicators of a country's foreign exchange reserves, exchange rate, financial health and interest rates, Nomura's "Damocles" model arrives at an overall score. Under the model, the total risk score for the 32 countries rose sharply to 2,234 from 1,744 in May this year.

"This is the highest value since July 1999 and not far from the peak of 2,692 hit at the height of the Asian financial crisis," Nomura economists said.

Based on data on 61 different emerging market currency crises since 1996, Nomura estimates that a score above 100 implies a 64% chance of a currency crisis in the next 12 months.

Egypt, which has already experienced two large currency devaluations this year and is seeking IMF assistance, currently has the highest score of 165.

Romania followed with 145 points. The country has been intervening to prop up its currency.

Debt-struggled Sri Lanka and currency-crisis Turkey each scored 138, while the Czech Republic, Pakistan and Hungary scored 126, 120 and 100, respectively.

egyptian pound

The Egyptian pound fell to a new low against the US dollar a few days ago, falling to 24.42, joining the top 10 worst-performing currencies in 2022.

Fitch Ratings recently downgraded the country's credit outlook to 'negative', citing higher risks of deteriorating external liquidity conditions for its currency and reduced access to bond markets. Meanwhile, Egypt's foreign exchange reserves have fallen from $35 billion in March to less than $32 billion in October.

Sri Lankan Rupee

Sri Lanka is facing its worst economic crisis since the country gained independence in 1948. According to data from the country's central bank in April, the exchange rate between the U.S. dollar and the Sri Lankan rupee has broken through the 1:300 mark, which was 1:203 at the beginning of March, a month-to-month drop of more than 32%.

The Financial Times reported that the Sri Lankan rupee "has fallen to an all-time low, making it the worst performing currency in the world".

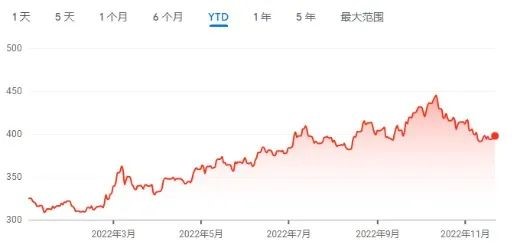

turkish lira

On the 24th, the Central Bank of Turkey announced that it would cut the benchmark interest rate by 150 basis points to 9%, and at the same time announced the end of this round of interest rate cut cycle.

Still, the lira has lost 29 percent of its value against the dollar this year, making it one of the worst-performing currencies in emerging markets after the Argentine peso.

In addition, Turkey's inflation rate has remained high since the beginning of this year. In October, the inflation rate reached 85.51%, the highest in 24 years.

Emerging market economies remain more vulnerable, Nomura said. Most countries have not yet fully recovered from the COVID-19 pandemic and are currently facing high inflation, limited fiscal space, negative real interest rates, weak balance of payments and reduced coverage of foreign exchange reserves. the

At the same time, he also conducted a "Damocles" model test on the major economies of the G7, and the results showed that, except for Japan, all countries' "Damocles" scores were above 100 points, with the United States and the United Kingdom at the forefront .